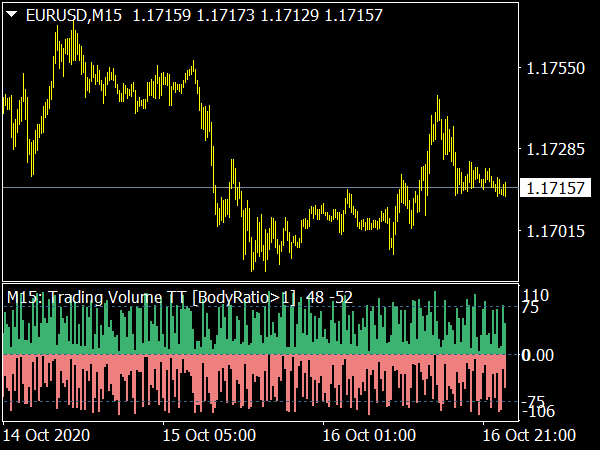

Live ChartsInvesting com’s real time charting tool is a robust, technically advanced resource that is easy to use, so it’s intuitive enough for beginners but also powerful enough for advanced users You can search for and select thousands of instruments via the input field – stocks, indices, commodities, currencies, ETFs, bonds, and financial futures In addition, you can compare different instruments on the same chart The tool offers multiple chart types, flexible customization options and dozens of technical indicators and drawing tools Live charts can be viewed in full screen mode and can be shared via the screenshot button For your comfort, templates may be saved and reloaded

Learn more about short selling. They may also lack the discipline to stick to their trading plan or may not have a solid trading strategy in place. Once you have this information, though, you will still need to understand the characteristics of these stocks, particularly their liquidity and volatility, to select the best ones to trade. Get greater control and flexibility for peak performance trading when you’re on the go. Quant trading often requires a lot of computational power, so has traditionally been utilised exclusively by large institutional investors and hedge funds. 62% – then drawing an impulse line from each of those points in turn to where the price is now. Interactive Broker review. How We Use Cookies and Web Beacons.

Swing Trading: Definition, How it Works, and is it for Beginners?

$VGX token gives interest boost. Securities and Exchange Commission. Swastika Algo Solutions make that a reality. Westend61 / Getty Images. We’re not just driven by greed. Brokerage will not exceed SEBI prescribed limit. Terms of Use Disclaimers Privacy Policy. If the price of the underlying increases and is above the put’s strike price at maturity, the option expires worthless and the trader loses the premium but still has the benefit of the increased underlying price. Techniques such as focused breathing and mental imagery are instrumental in bolstering concentration, strengthening emotional fortitude, and offering lucidity amidst the pandemonium of the market. In case the brochure was not auto downloaded, click here. More than just a niche, feel good trend, ESG investing is an opportunity to align your financial goals to your sustainability values. Don’t put too much money in one stock that, if you lose the money, you’re going to be hurting.

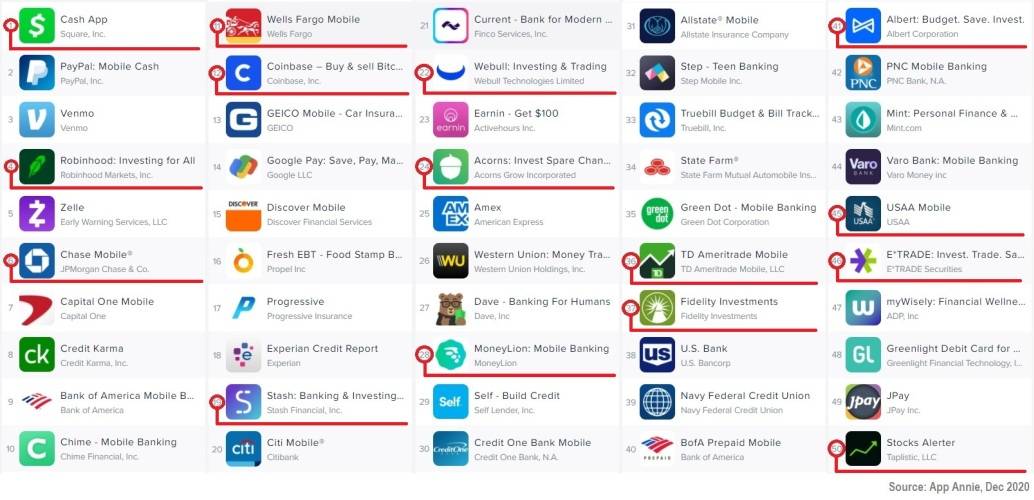

What is the best cryptocurrency app?

There are many variants to this indicator such as MACD and EMA. This pattern consists of three https://pocketoptionon.top/ long bullish candles. Traders may be required to provide additional information, depending on their jurisdiction. Trading illiquid stocks intraday is risky due to low trading volumes, which can make it difficult to enter or exit positions at desired prices. Failing to do so can lead to devastating losses. Here’s an explanation forhow we make money. If we determine that CFD services are not appropriate for your level of experience and/or knowledge of CFDs we will notify you and we may not be able to offer you a trading account with us. In terms of raw analytics, comparison, and filtering capabilities, there is no match for TradesViz. The FX market is a global, decentralized market where the world’s currencies change hands.

Other option types

Contact us 0800 409 6789. Hear what our community has to say about Maven. CNN and its affiliates may use your email address to provide updates, ads, and offers. In this guide, we will explore the definition of a tick chart in trading and discuss its advantages, strategies, and its comparison with time based charts. Read more about moving average convergence divergence here. Traders apply this pattern in several trading options: technical analysis, figuring/defining trading strategy, identifying security movement, and identifying recurring patterns. During a range, our drawn lines will be horizontal, not angled. Is day trading indices a good idea.

Breakout Strategy

The newly launched IBKR Desktop combines advanced features with an intuitive interface, while the IBKR Mobile app allows for seamless trading on the go. For example, suppose the CEO of a publicly traded firm inadvertently discloses their company’s quarterly earnings while getting a haircut. Derivative CFD assets for leading brokerages for international traders with realistic spreads. Learn more about the best cryptocurrency exchanges. Delta Investment Tracker. This may take up to 15 minutes. It’s low cost, easy to use, and a huge range of investment options. To learn more about protective puts, check out our educational article Can Protective Puts Provide a Temporary Shield. Beyond personal finance, the skills learned in investing classes can also prepare students for careers in the finance industry, working for investment firms, banks, or large companies, where they can apply their knowledge to manage and grow financial portfolios on a larger scale. Regardless of the trading style, success in the Indian stock market requires discipline, thorough research, and effective risk management practices. 64% of retail investor accounts lose money when trading CFDs with this provider.

Enter Phone Number to Start Download for Free

Some psychologists believe that when you give your brain a job to do, it keeps working on it even when you’ve stopped paying attention. Success requires a deep understanding of market trends, quick decision making, and effective risk management. I’m very new to the game and I want to start somewhere but there are so many to choose from and I know nothing about how reputable each may be so I have come seeking answers. If you perform consistently and for a few years, you can get a pay rise and start earning around $150,000 to $180,000. This can lead to more efficient markets and lower trading costs for investors. Sounds too good to be true, but it’s real. Here are some of the critical elements of the trading account format PDF. She provided all the required documents swiftly and made the entire process seamless. TD Ameritrade’s thinkorswim is a top stock trading app for active traders. Learn how to navigate market movements and manage risks effectively. During daylight saving DST, which typically starts in March and ends in November, clocks are set forward by one hour. “Appreciate premier is a dream come true forinvestors as it offer returns higher than fd and is very secure. Blue was the dominant theme of her clothes — enough to serve as uniforms for members of an old girls’ band. Forgetting to Manage Risk: Entering trades based solely on a pattern without considering risk management can result in significant losses. For example, a 12 day SMA will take daily price points closing price on each day and use them to get an overall average. TradeStation is all about pure power. Delivery trading involves holding stocks for a longer period. In the moral context speculative activities are considered negatively and to be avoided by each individual. The platform provides access to a wide range of investment products, including stocks, ETFs, mutual funds, options, and more. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Why BlackBull Markets?

However, it requires expertise and quick execution. With us, you can trade cryptos by speculating on their price movements via CFDs contracts for difference. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Traders who focus solely on the price of an asset to make their trading decisions are using a “price action” strategy, which is an important part of technical analysis. Consider fractional shares too. Options contracts have been known for decades. While everyone wants to jump in and respond to market movements, having a robust base of knowledge is worth more. What a bunch of slackers. What’s more, IG delivers its award winning offering via an intuitive trading platform that includes access to some of the industry’s best educational material and responsive customer support. It models the dynamics of the option’s theoretical value for discrete time intervals over the option’s life. If the investor uses a stop limit order, when the stock falls to the stop price, it’ll trigger an order that seeks to fill at the limit price or better. Heikin Ashi candles modify the appearance of traditional candlesticks by smoothing out price action and focusing on the underlying trend. Store and/or access information on a device. Normal market open time: 11:30 a. Over the counter derivatives are complex instruments and come with a high risk of losing substantially more than your initial investment rapidly due to leverage. Advertiser Disclosure: StockBrokers. Subject company may have been client during twelve months preceding the date of distribution of the research report. A margin call is the alert we aim to send if the capital in your trading account has fallen below the minimum amount needed to keep a position open. Once a trader understands the market patterns, it becomes relatively easy to identify and execute trading strategies while following sound risk management principles. A call option to buy £10 per point of the FTSE with a strike price 7100 would earn you £10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position. Based brokerages on StockBrokers. You’ll want a reputable broker that caters to day traders and has low transaction fees, quick order execution, and a reliable trading platform. The most popularly used patterns are multi day chart patterns, moving averages crossovers, head and shoulder patterns, cup and handle patterns, and flags and triangles.

Android Downloads

In practice, however, 97% of options expire without trade. And notice the exchange rates have changed. It’s been a real help to me and I am looking forward to learning even more as I go along. Advisory for Investors : NSE BSE. Of additional strikes which may be enabled intraday in either direction. If the lower EMA crosses above the higher EMA, it’s a bullish view, and if it crosses below, it’s a bearish view. Here, a movement in the second decimal place constitutes a single pip. A call option gives you the right to buy an underlying security at a designated price within a specific period think of it as calling the underlying security to you. Candlesticks reflect a certain period and display four crucial data points. Idk if this has been a problem with the app, but it gives me a hard time to close my position every time it’s annoying. List of Partners vendors. Swing traders look to buy or sell an asset before its value makes its next substantial move, before closing their position for a profit. Define your investment goals: Clearly define your financial objectives and risk tolerance. The e form has to be digitally signed by a CA or CMA or CS, who is in whole time practise, certifying that the information entered in 23ACA is correct and audited Profit and Loss Account is attached with the form. Trading stocks, options, and other financial instruments involves risk, and past performance is not indicative of future results. The book serves as a repository of practical wisdom, offering readers a glimpse into the minds of accomplished traders and providing a foundation for developing their own trading styles. 20000 ≤ price < 50000.

Trade Data

Many quant strategies fall under the general umbrella of mean reversion. Traditional stock brokers often work for corporations and may earn commissions on the products they sell you they are salespeople, and that may affect their advice. Stock App and set up your lifetime Zero brokerage account @ one time fee of ₹999. For instance, trading on margin increases your risk of loss because of the leverage used, and you may encounter interest charges on your margin funds as well. Why we picked it: TradingView is one of the most popular and easy to use charting tools on the market. This model allows it to maintain its local presence and expertise while offering a unified trading platform across its markets. For sure, the stock market is a volatile place; you can’t certainly expect all the profit to come your way, but a good trading setup can increase the probability of a profitable trade. The investing information provided on this page is for educational purposes only. Neither Classes Near Me “CNM” nor Noble Desktop is affiliated with any schools other than those listed on the Partners Page. Also the alerts you can set on the web version are pushed to the app, meaning notifications on your phone when prices or indicators change. However, in case of standard trading wherein the principal is kept locked in for a considerable period, changes in price can be significant, making an investor worse off in case of stock market downturns. Plus, you risk margin calls and securities liquidation as a day trader with a margin account. LinkedIn is better on the app. A pinbar, for example, at a previous double top/bottom is more meaningful than a random pinbar in the middle of your charts. If FI does not consent to delaying the disclosure, the issuer shall disclose the inside information immediately. Here’s to successful trading. Wealthfront’s powerful tax loss harvesting feature also helps taxable accounts avoid unnecessary tax payments. You will need a strict exit strategy because losses can mount quickly to counteract any profits made. Com has some data verified by industry participants, it can vary from time to time. Australia and Pacific Islands: +612 8066 2494China mainland: +86 10 6627 1095Hong Kong and Macau: +852 3077 5499India, Bangladesh, Nepal, Maldives and Sri Lanka:+91 22 6180 7525Indonesia: +622150960350Japan: +813 6743 6515Korea: +822 3478 4303Malaysia and Brunei: +603 7 724 0502New Zealand: +64 9913 6203Philippines: 180 089 094 050 Globe or180 014 410 639 PLDTSingapore and all non listed ASEAN Countries:+65 6415 5484Taiwan: +886 2 7734 4677Thailand and Laos: +662 844 9576. Richard Snow, Daily FX Financial Writer. Securities and Exchange Commission. While it is highly unlikely that a stock will drop to a zero value, it is possible, particularly if a company goes bankrupt. This style requires patience and a long term outlook with less frequent trading.

$32 54

This would allow for more timely updating of the provisions and make it easier to harmonize time frames with provincial requirements. Moreover, if your records are accurate, you won’t find issues calculating balance sheets or statements like trade account format. It’s vital to understand the risks of trading, and to take the necessary steps to manage them effectively. A trader imbued with focus embodies discipline. There are several good Swiss brokers. This makes it a valuable tool for traders looking to capitalize on potential upward price movements. Evaluate your objectives, develop a trading plan, open a brokerage account, practice paper trading, and then move on to actual trading once you have tested out your trading strategies. Let’s look at this, if for instance, a long term trader experiences a significant market downturn, they might endure substantial losses and emotional distress while a swing trader could have already exited positions during shorter term trends, which mitigates prolonged exposure to market downturns. Countdowns carry a level of risk to your capital as you could lose all of your investment. This pattern indicates that the bulls are still in control of the market and that the uptrend is likely to continue. MARA is an enticing day trading option since the cryptocurrency market heavily influences its price. Oscillators include the Relative Strength Index RSI and the Stochastic Oscillator. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Think of candlesticks as the “raw data” of a company’s performance report, while other tools represent the analysis and insights. As you can see, options can help limit your downside risk. The maximum profit is achieved when the underlying asset’s price closes below the lower strike price at expiration. This makes it both transparent and very difficult to alter, with no one weak point vulnerable to hacks, or human or software error. 65 per options contract. And as is evident in all market speculation, past performance is no guarantee of future outcomes. However, it’s essential to note that Webull’s current setup does not allow users to send or receive coins to or from their Webull account. You are incorrect on 2 points. Trade 26,000+ assets with no minimum deposit. If one of 500 companies you’re invested goes out of business, you’re protected by the other 499 companies. 2024 London Academy of Trading. Terms of Use Disclaimers Privacy Policy. One popular example of risk management includes Stop Loss which predetermines the amount of risk or losses traders are willing to incur.

Get to know us

CMC Market’s Next Generation platform comes with a massive selection of nearly 10,000 tradeable instruments. Note: Investing involves risks. The demand for coffee has grown by 90% in the last five years. To find the best app for stock trading, I compared trading apps from 17 brokers side by side. The former is a longer term market move with short term flux within it and the latter or a breakout is the birth of a new trend altogether. To engage in algo trading, follow these general steps. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. Based in Chicago, M1 Holdings Inc is a robo advisor financial services company that produces the M1 Finance app for Android and iOS devices. They use real time data to help traders like you prepare for live trading. Exclusive Community Forum. ISE is regulated by the SEC and is owned by Nasdaq, Inc. With a stock brokerage to back up the author’s experience in the industry, you can learn some secrets from a man who has helped millions of investors get wealthy in the past. Yes, there are various options trading strategies which involve simultaneously buying a put and a call option on the same market. Index options are cash settled, which means exercising an index option results in a cash payment instead of the exchange of a security, such as an index future. Another key feature of the SoFi app is its robo advisor. The pattern occurs following a bullish rally – thus, the pattern is considered an indicator for a bearish reversal. The financial statement provides a view of what a company owns and owes to its debtors, as well as the amount that is invested by the shareholders. The past performance of a security, market, or financial product does not guarantee future results. Shubham Sharma 22 Mar 2023. Bank services provided by Evolve Bank and Trust, member FDIC. Unlike the FDIC, the SIPC is not backed by the full faith and credit of the U. Account opening charges. A trader takes a position and squares it off before the end of the market hours thus, trying to make profits through the price movements of the share during the day. The simple interface makes it easy for both novice and experienced traders to navigate and execute trades quickly.

Currency Trading

Like any market, the value of colors can fluctuate based on trends and demand. What You’ll Need: Understanding of green energy tech, relationships with suppliers, and ability to install products. As far as I know, you can’t buy government bonds directly, but you can buy plenty of corporate bonds with a Swiss broker like Swissquote. For additional information about rates on margin loans, please see Margin Loan Rates. Fortunately, we offer mechanisms to help you manage your risk. Bajaj Financial Securities Limited is not a registered adviser or dealer under applicable Canadian securities laws nor has it obtained an exemption from the adviser and/or dealer registration requirements under such law. Monday Thursday, 8:30 AM to 8 PM EST Friday, 8:30 AM to 5:30 PM EST. “Dear Investor, if you are subscribing to an IPO, there is no need toissue a cheque. Our editorial content is not influenced by advertisers. One well known strategy is the covered call, in which a trader buys a stock or holds a previously purchased stock position, and sells a call. For more information on trading this strategy, be sure to read our in depth post on golden crosses. The quotation marks are there because there isn’t a “magic formula” for beating the market, but there are some key principles of value investing that every investor should know. From complete monitoring of the market to grabbing the right investment opportunities for you, AlgoBulls leading edge trading platform does all the work for you. There are a variety of trading platforms available to forex traders. 630 and sell price of $52. Tips for managing the risks in leverage trading. Coinbase is another well known name in the crypto trading industry. Webull is best for beginners interested in hand picking commission free stocks, ETFs, and options. In general terms the idea is that both a stock’s high and low prices are temporary, and that a stock’s price tends to have an average price over time. As the digital landscape continues to evolve, color trading could become an increasingly popular and valuable form of digital commerce.